5 Sustainable-Investing Trends to Watch in 2026

Sustainable investing will enter 2026 at a critical juncture. The past year brought political headwinds and regulatory setbacks, prompting some investors to question the importance of sustainability. In this context, we outline key trends likely to shape sustainable-investing conversations in 2026, including climate transition and adaptation, soaring investment in renewable energy, and a growing sustainable bond market, among others.

Sustainable Investing Recalibrated

Amid geopolitical tensions, ESG backlash, and uneven policy progress, sustainable investing is shifting toward greater realism and pragmatism. In 2025, new standards emerged, strategies were redefined, scopes broadened, and narratives were reframed around growth opportunities, security, and resilience. In 2026, the priority will be for the industry to demonstrate the tangible value of sustainability considerations and to drive innovation.

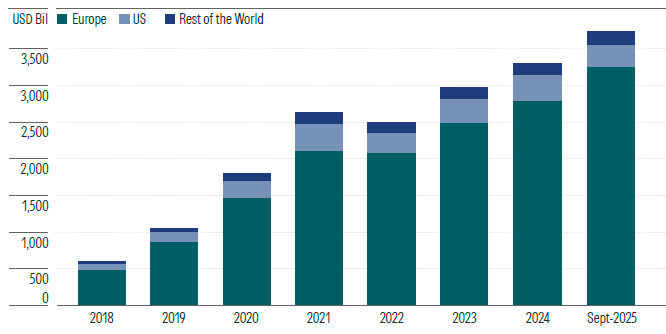

Meanwhile, 2025 is on track to record the first—albeit modest—annual outflows for global ESG-focused open-end funds and exchange-traded funds since Morningstar began tracking this universe in 2018. But total ESG fund assets remain high, totaling $3.7 trillion globally at the end of September. In Europe, ESG funds still account for 20% of the overall fund universe, compared with just 1% in the US, with varying shares across other regions.

Moreover, recent investor surveys point to a bright future for sustainable investing. According to one conducted by the Morgan Stanley Institute for Sustainable Investing, 88% of global individual investors are interested in sustainable investing. The younger generation shows the greatest interest, signaling that sustainability will become an even stronger focus as their financial influence grows. Similarly, 86% of asset owners expect to increase allocations to sustainable investments in the next two years.

Climate Risks Evolve: From Transition to Adaptation

Despite the negative headlines and some pullbacks, climate change is set to rise higher on investors’ agendas in 2026. We expect the focus to remain on climate transition, while increased attention will be paid to physical climate risks and adaptation.

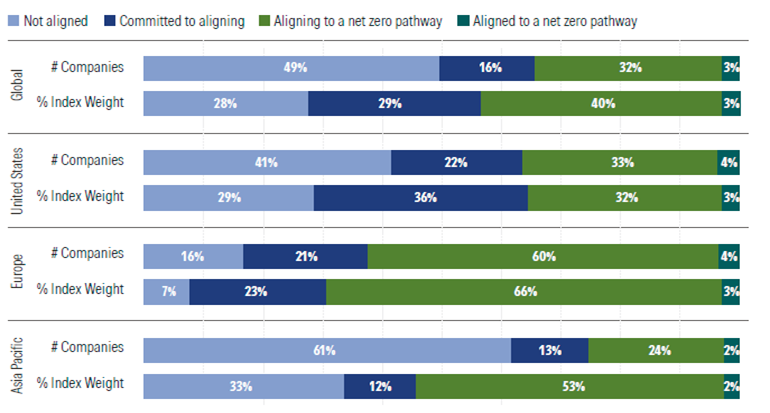

The key challenge for investors will remain assessing the credibility of companies’ emissions reduction targets and transition plans. Using the Net Zero Investment framework and Morningstar Sustainalytics’ data, we found that less than 3% of companies in the Morningstar Global Target Market Exposure Index are currently aligned to a net zero pathway, while almost half (49%) are not aligned, meaning that they have no publicly stated ambition yet to decarbonize on a pathway to achieving net zero. This highlights the critical role of constant investor action through corporate engagement and policy advocacy.

As mitigation fails to accelerate at the pace required to limit global warming to safe levels, businesses and investors increasingly recognize the urgency of adapting to a warmer world and more extreme weather events. This requires better assessment of physical climate risks.

Frameworks are also being developed to identify opportunities across a broad range of sectors, including infrastructure, water management, healthcare, agriculture, and insurance. Yet, investors’ options in the form of dedicated funds or strategies remain limited. Adaptation faces multiple challenges, including uncertain cash flows, long time horizons, fragmented markets, lack of standardized disclosures, and dependence on public or regulatory action. These challenges should be addressed gradually, starting with more and better estimates of potential financial losses.

Accelerating Investments in the Energy Transition

Meanwhile, the opportunities created by the energy transition will become even clearer, with private markets playing a larger role in scaling infrastructure and driving innovation.

Looking ahead to 2026, global investment in renewables across all markets is set to continue to soar. In the US, growth will remain fueled by data centers, despite political headwinds, while in Europe, alongside the rapid expansion of data centers by hyperscalers such as Microsoft, Google, and Amazon, the strategic role of clean energy—central to energy security and independence—will keep momentum strong.

However, the renewable energy sector is far from uniform, as the outlook for each technology is shaped by its own drivers. Investors are likely to remain discerning, while also considering the state of the electrical grid, which is essential to support rising energy demand. In many places, investments in grid infrastructure have not kept pace with investments in renewable energy.

Another key consideration in 2026 will be the supply of critical minerals—such as lithium, cobalt, nickel, and rare-earth elements—which currently lags the rising demand. National security concerns, particularly around dependence on China, will continue to shape investment flows into mining, processing, and alternative sourcing strategies.

A Maturing Sustainable Bond Market

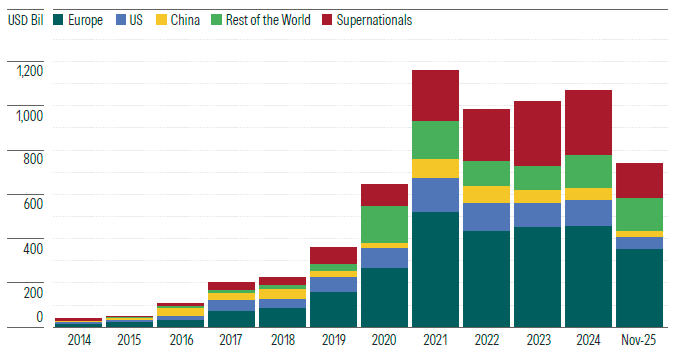

In line with 2025, we expect 2026 to reflect the continued maturation of the green, social, sustainability, and sustainability-linked bond market, now exceeding $6 trillion. Issuance volume will depend on geopolitical developments, interest rate trends, and financial innovation.

The year will also be defined by stronger standards and a sharper focus on measurable impact. Supported by new industry guidance, we could see more transition-related issuances, particularly in carbon-intensive sectors such as steel, aviation, and energy. The growth ahead will likely come from the Association of Southeast Asian Nations region, where decarbonization needs are the greatest and transition is the focus of multiple taxonomies.

Investors at the Front Line of Biodiversity Action

Regulatory progress on biodiversity has stalled, yet investor concerns continue to grow. Despite the persistent lack of high-quality data, investors are increasingly eager to integrate biodiversity considerations into their decision-making—focusing on the most material sectors and their key impacts on nature.

Momentum is already visible. Biodiversity-linked bonds have grown from 5% of green issuances in 2020 to 16% in 2023. More recently, Ecuador’s issuance of a $1.6 billion debt-for-nature swap in 2024, Goldman Sachs’ launch of a $500 million biodiversity fixed-income fund in 2025, and Tideway’s issuance of a GBP 250 million blue bond illustrate accelerating capital flows.

Financial solutions for nature are likely to further scale up as credibility strengthens and standardized metrics and reporting support broader adoption. Frameworks such as the EU’s Roadmap towards Nature Credits and International Capital Market Association’s Sustainable Bonds for Nature mark important steps forward.

Artificial Intelligence: Key ESG Risks to Monitor

Investors increasingly recognize that AI is highly energy and water intensive. How companies will meet the growing power demand, though, while also reducing their carbon footprint, is uncertain. In the US—the primary AI hub—Morningstar projects that data center power demand will triple by 2030, with only 25% of the incremental load met by renewables and the remainder supplied by natural gas (60%) and nuclear energy (15%).

With 2030 just four years away, tech companies increasingly face a credibility problem as their carbon emissions keep rising, instead of decreasing. In the last proxy season, investors asked Amazon, Meta, and Alphabet how they planned to meet their ambitious climate commitments and whether their renewable energy procurement strategies were still credible. We expect similar shareholder resolutions to appear in 2026 across the broader technology sector, as the tension between digital infrastructure growth and decarbonization intensifies.

Beyond the environmental impacts, AI-related breaches and misinformation will likely gain prominence in 2026. Meanwhile, we expect navigating AI for both developers and users to remain fairly fluid, as regulation continues to evolve.

Companies that adopt best practices in AI governance will be better positioned to protect stakeholder trust and capture long-term value.

To read the report: Sustainable Investing Trends to Watch in 2026

link