US ESG Fund Flows Continue to Improve in Q3

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

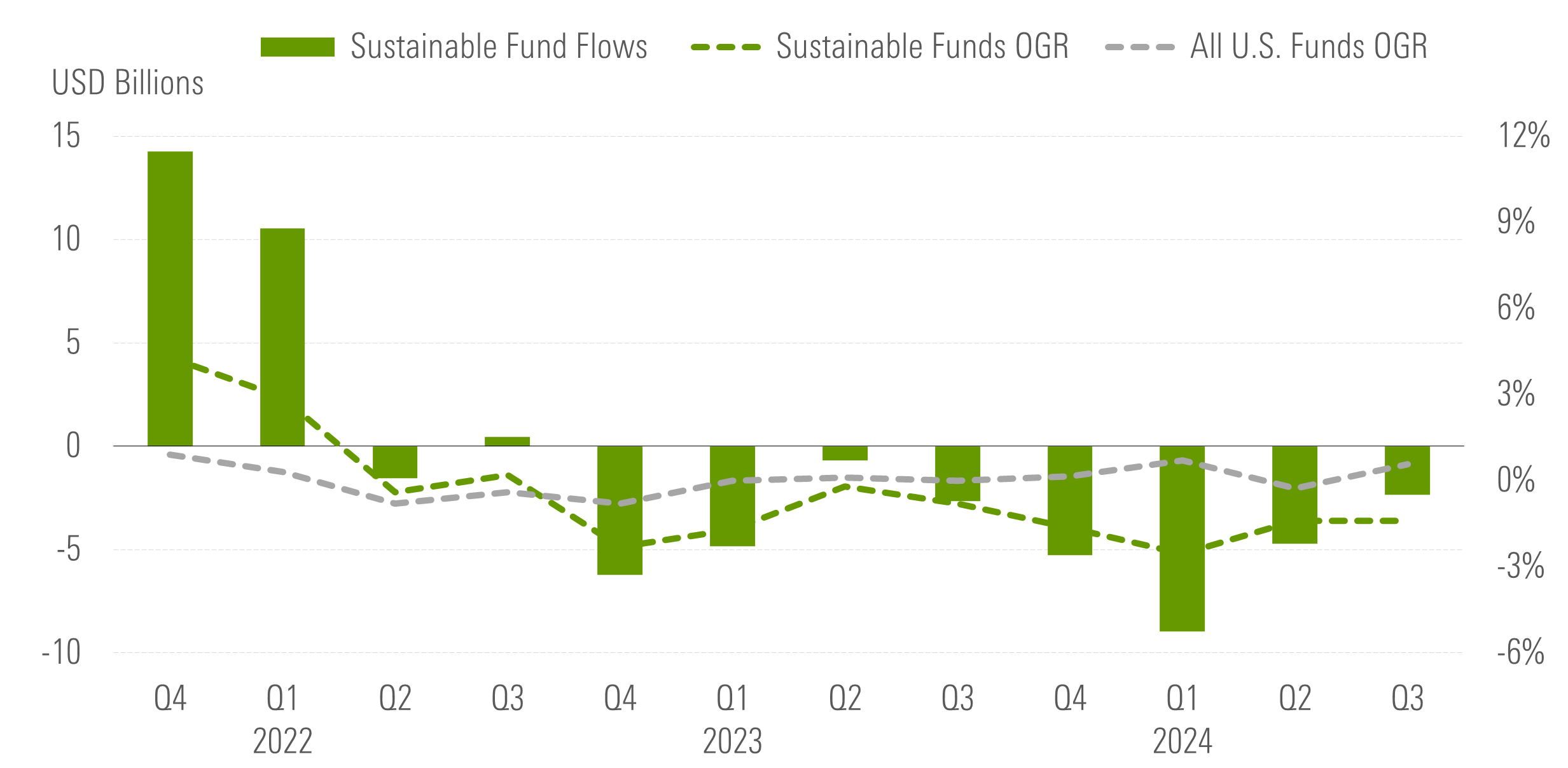

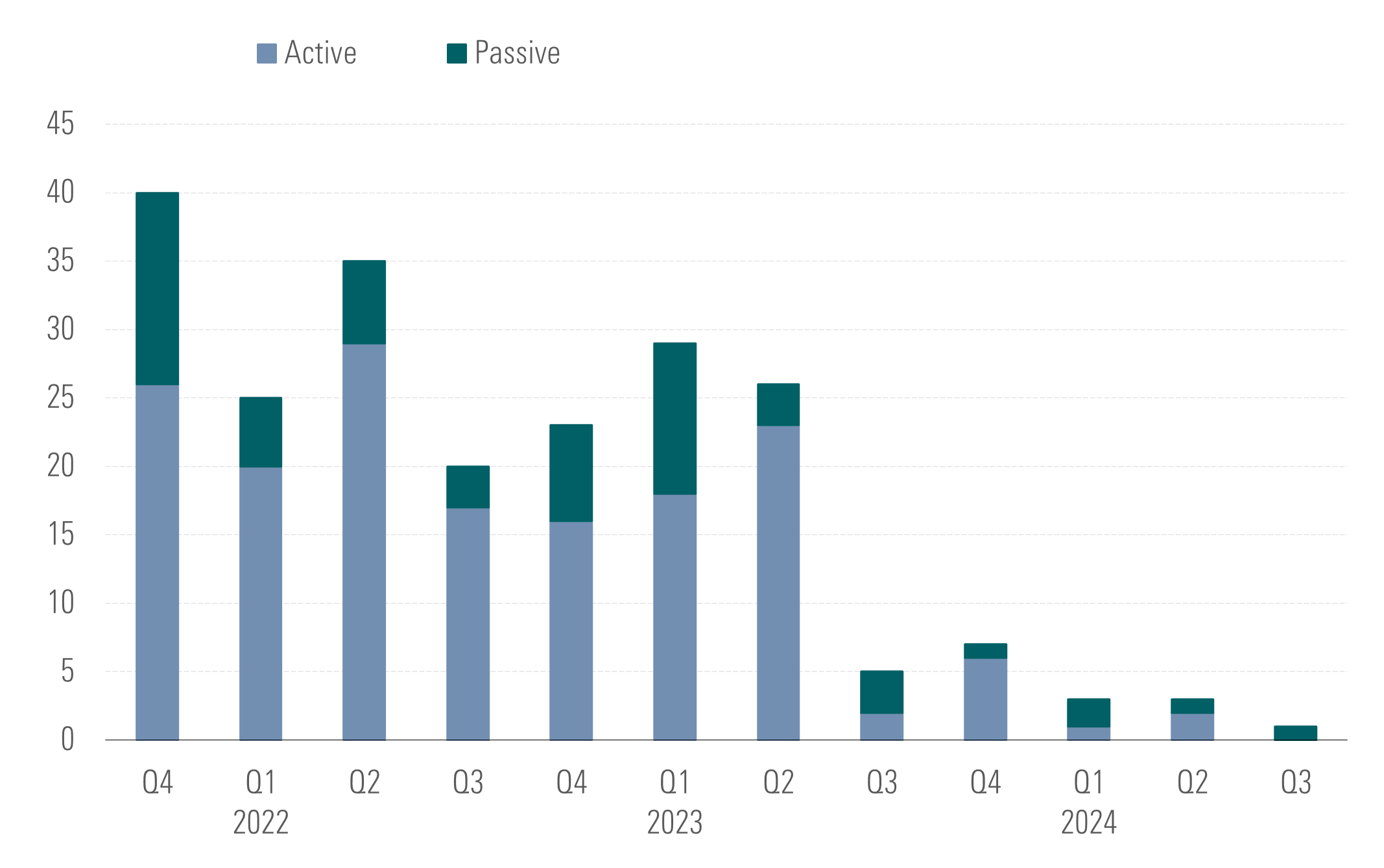

In the third quarter of 2024, US investors pulled money out of environmental, social, and governance-focused funds for the eighth consecutive quarter, but the net outflows of $2.3 billion were the lowest registered since late 2023. Net withdrawals shrank by almost 50% from the previous quarter. The numbers suggest a steady reduction in outflows.

Meanwhile, the overall US market of funds had an organic growth rate of 0.6% over the three months. By comparison, US sustainable funds contracted by 1.4%, almost identical to the previous quarter. The organic growth rate, calculated as net flows over the period divided by total assets at the beginning of the period, provides insight into the relative magnitude of net flows.

Although the motivations behind the continuous outflows cannot be precisely quantified, several key factors contribute to this trend. These include high interest rates, which have made alternative investment options more appealing and diminish the attractiveness of ESG funds. Additionally, the mediocre returns of ESG funds in 2023 have led to investor dissatisfaction and subsequent withdrawals. Concerns about greenwashing have also contributed to reduced investor confidence, as skepticism grows regarding the genuine sustainability credentials of some funds. Furthermore, the increasing politicization and regulatory scrutiny of ESG investing have prompted some investors to reevaluate their positions, resulting in further outflows.

Active ESG strategies continued to bleed money ($3.6 billion), but index-tracking ESG products recovered and registered inflows of $1.3 billion.

Among US ESG Funds, Bond Funds Gain While Equity Funds Suffer

Unlike ESG equity funds, ESG bond funds kept positive momentum with a modest $724 million collection, representing an increase from the restated $103 million from the previous quarter. Conversely, ESG equity funds shed $3 billion over the quarter. Elevated interest rates make fixed-income investments more attractive as they offer better returns with lower risk compared with equities.

Leaders and Laggards

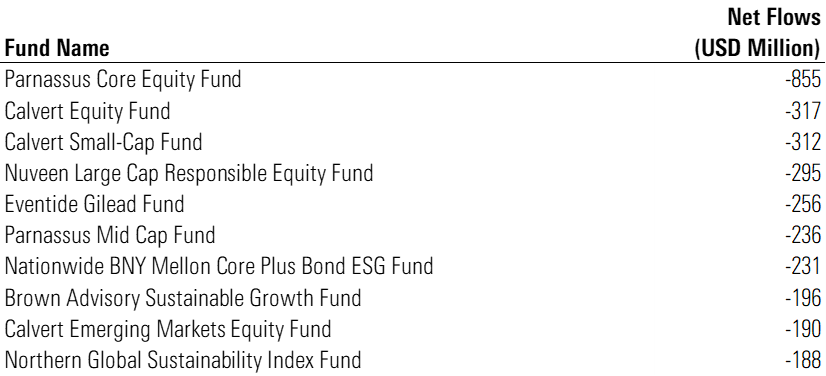

Among the largest net withdrawals, again we find Parnassus Core Equity PRBLX, which shed $855 million. The fund focuses on investing in large-cap US companies with sustainable competitive advantages, quality management, and positive ESG performance. Long known as the largest US ESG fund, Parnassus Core Equity has been one of the 10 biggest losers in terms of outflows for more than two years straight, shedding about $6 billion over that period. Parnassus attributes a portion of the fund’s outflows to the launch of a less expensive collective investment trust and the subsequent conversion of investors from one vehicle to the other.

The list of worst-selling ESG funds also includes three Calvert funds—Calvert Equity, Calvert Small-Cap Equity, and Calvert Emerging Markets—with combined outflows of $820 million.

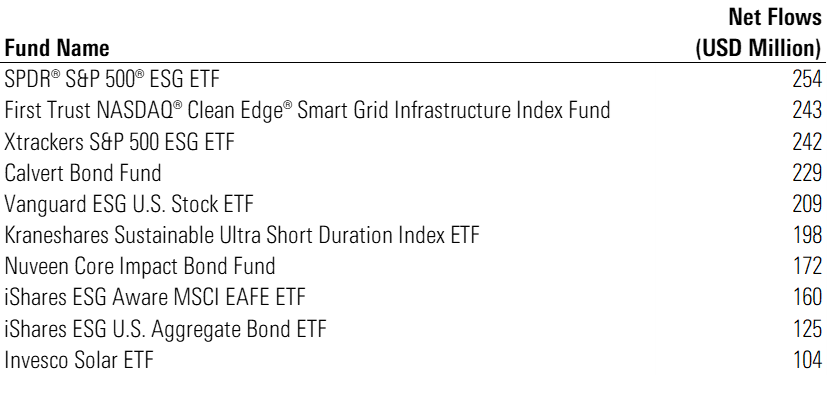

In the third quarter of 2024, the standout performer in terms of inflows was SPDR S&P 500 ESG ETF EFIV, which garnered $254 million. This exchange-traded fund aims to provide exposure to companies that meet certain sustainability criteria while maintaining similar overall industry group weights as the parent index. First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index GRID remained high in the league table, with $243 million of net new money, after garnering $456 million over the previous quarter.

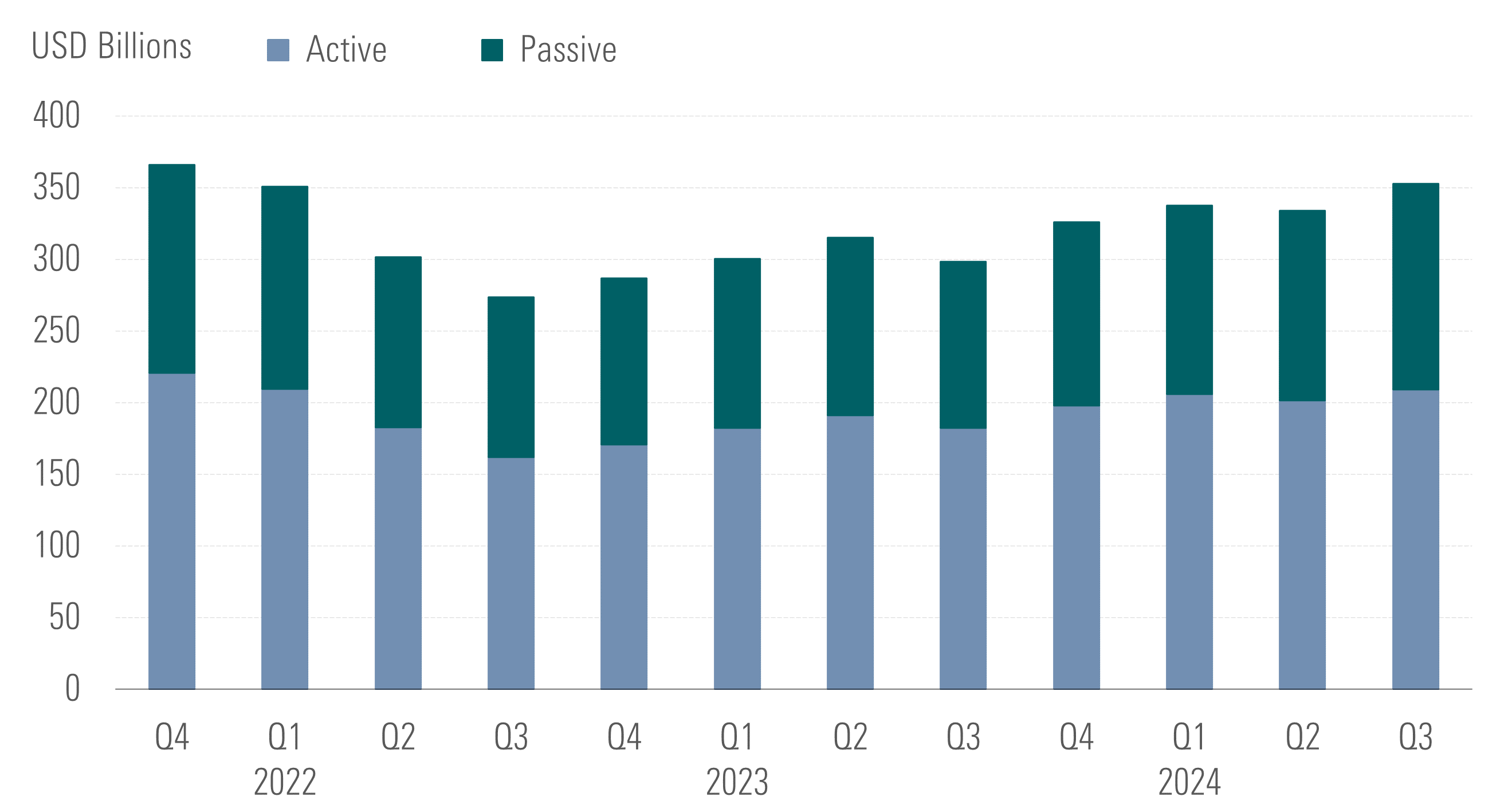

Assets in ESG Funds Remain Roughly Unchanged

Meanwhile, assets in US-domiciled ESG funds increased by 5.6% to $352 billion at the end of September 2024 from a revised $333 billion three months earlier, helped by market price appreciation. The asset growth was on par with the Morningstar US Market Index, which gained 5.7% over the same period.

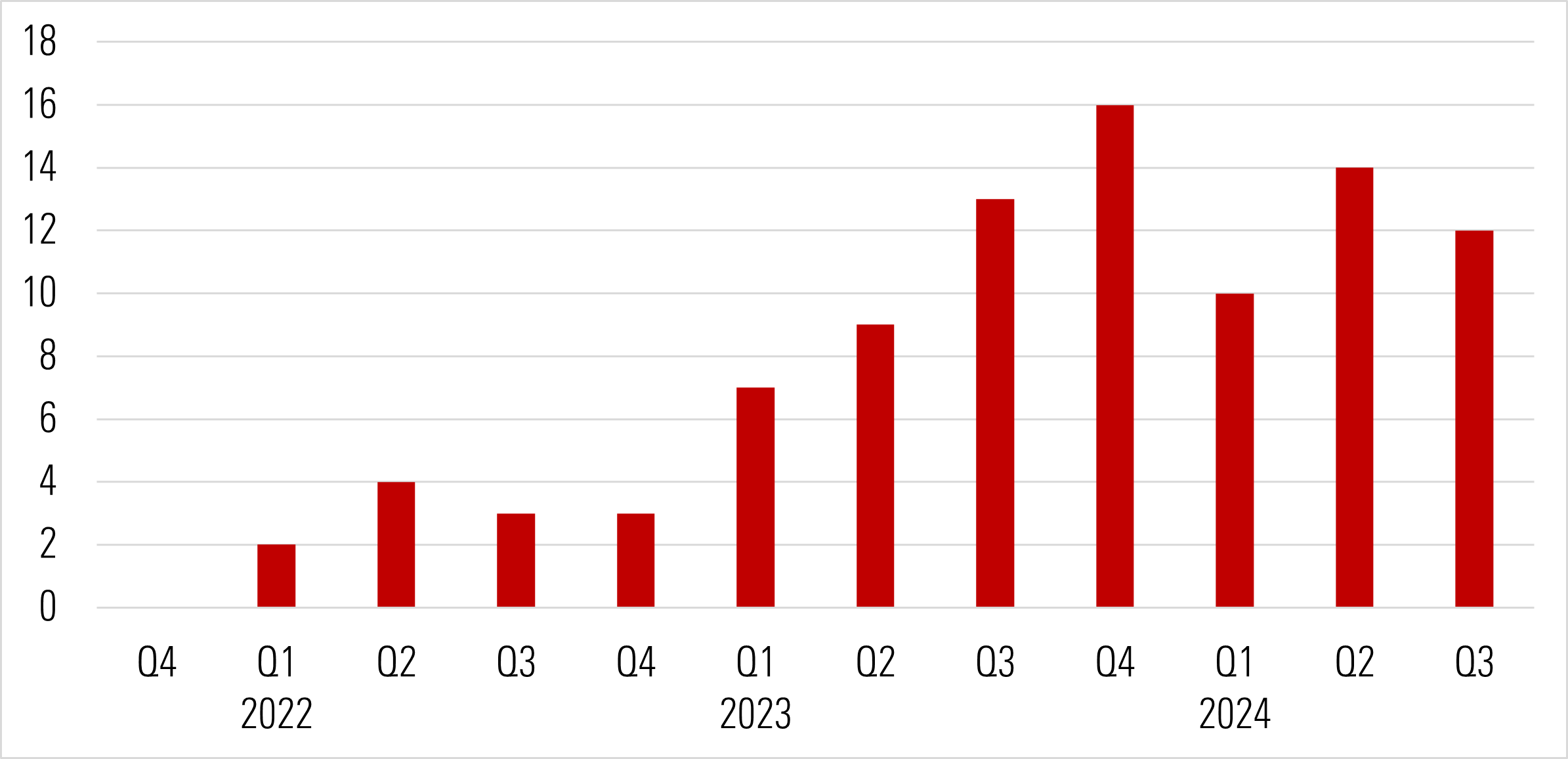

New ESG Fund Launches Remain Low

The third quarter of 2024 saw the launch of only one ESG fund, KraneShares Sustainable Ultra Short Duration Index ETF KCSH. The fund targets investment-grade corporate bonds with very short maturities issued by companies that are making progress toward reducing their carbon emissions in line with the goals of the Paris Agreement and that are adopting sustainable practices.

The 12 US ESG funds that were liquidated include five managed by BlackRock (Sustainable Advantage CoreAlpha Bond, Sustainable International Equity, Sustainable Low Duration Bond, Future Climate and Sustainable Economy ETF, and Sustainable US Growth Equity), in addition to AMG GW&K Enhanced Core Bond ESG, Ashmore Emerging Markets Corporate Income ESG, Blue Horizon BNE ETF, Direxion Daily Global Clean Energy Bull 2X Shares, Direxion Hydrogen ETF, Templeton International Climate Change, and Veridien Climate Action ETF.

The new offerings and repurposed funds brought the total number of ESG open-end and exchange-traded funds in the United States to 595 at the end of the third quarter.

Regulatory Update

California has signed a new bill into law, slightly delaying but confirming the promulgation of the rules requiring large companies doing business in the state to disclose their greenhouse gas emissions. Most importantly, 2026 remains the proposed start date for the reporting to begin. The new laws (SB 253 and SB 261), subject to legal challenges, would effectively introduce climate-reporting obligations aligned with the Task Force on Climate-Related Financial Disclosures for most large businesses in the US, considering the $1 billion in total annual revenue threshold that sets the scope.

To read the full report, click here.

link